Ethereum And Bitcoin Predictions Insights And Analysis

With ethereum and bitcoin predictions at the forefront, this exploration dives deep into the fascinating world of cryptocurrencies, revealing what the future might hold for these digital giants. As both Bitcoin and Ethereum continue to shape the financial landscape, understanding their differences, market trends, and future forecasts becomes essential for investors and enthusiasts alike.

From the historical context that birthed these cryptocurrencies to the innovative technology driving their evolution, this discussion will cover pivotal aspects including market trends, expert predictions, and the regulatory environment surrounding both assets. With significant implications for investors, the insights shared will illuminate the paths these cryptocurrencies may take in the near future.

Overview of Ethereum and Bitcoin

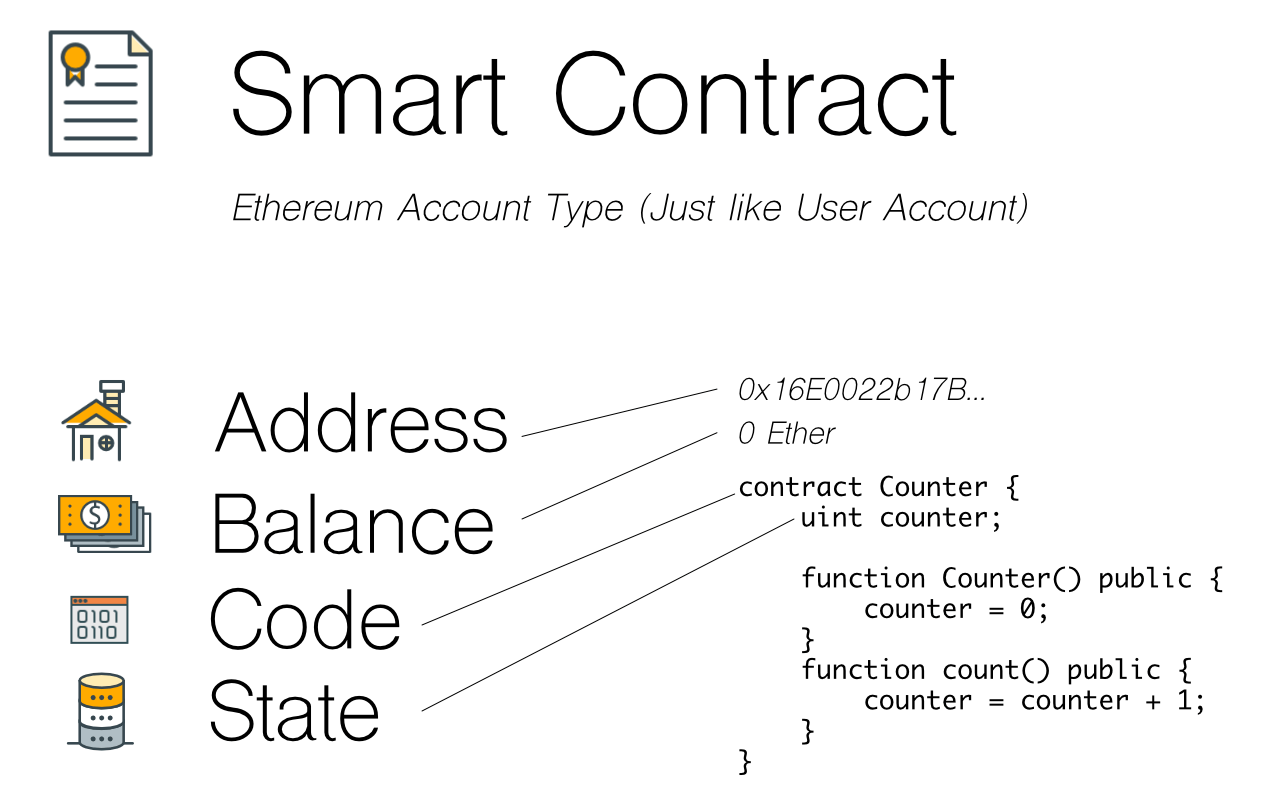

Bitcoin and Ethereum are the two most significant cryptocurrencies, each serving distinct purposes in the crypto ecosystem. Bitcoin, introduced by an anonymous person or group known as Satoshi Nakamoto in 2009, primarily functions as a digital currency and a store of value. In contrast, Ethereum, launched in 2015 by Vitalik Buterin and others, serves not only as a cryptocurrency but also as a platform for decentralized applications (dApps) and smart contracts.

Historically, Bitcoin emerged as the first cryptocurrency, addressing the need for a decentralized and digital form of money. Ethereum followed, aiming to expand the functionalities of blockchain technology. Ethereum’s unique feature lies in its ability to execute smart contracts, facilitating complex transactions beyond mere currency transfers, which is Bitcoin’s primary use case.

Current Market Trends

In recent months, both Bitcoin and Ethereum have experienced notable fluctuations in their market trends. Bitcoin, often regarded as the market leader, has seen its market capitalization hover around $800 billion, while Ethereum’s market capitalization has reached approximately $400 billion. Trading volumes for Bitcoin typically surpass $20 billion daily, with Ethereum closely following at around $8 billion.Global economic events, such as inflation concerns and regulatory developments, have significantly impacted the values of these cryptocurrencies.

For instance, during periods of heightened inflation fears, Bitcoin often sees increased buy-in as investors seek a hedge against traditional economic instability. Similarly, Ethereum’s value can spike with advancements in DeFi applications, reflecting shifting investor interests.

Future Predictions

Expert predictions suggest that Bitcoin could reach a price of $100,000 within the next year, driven by institutional adoption and the limited supply of coins. Analysts highlight the growing interest from major corporations and financial institutions as a catalyst for this potential growth. Meanwhile, Ethereum is expected to undergo significant upgrades, particularly with the transition to Ethereum 2.0, which may enhance its scalability and transaction efficiency.

These developments could lead to Ethereum’s market value reaching new heights, potentially rivaling Bitcoin’s dominance. The long-term growth potential of both cryptocurrencies appears promising; however, Bitcoin’s established brand and market presence present a formidable barrier for Ethereum in the race for market capitalization.

Technological Advancements

Ethereum is on the brink of implementing several technological innovations, most notably the transition to a proof-of-stake consensus mechanism. This change is anticipated to reduce energy consumption significantly and enhance transaction speeds. Additionally, Ethereum’s Layer 2 solutions, like Optimistic Rollups and zk-Rollups, aim to address scalability issues, allowing for a higher throughput of transactions.On the other hand, Bitcoin faces challenges regarding scalability.

The network’s current throughput limits can lead to higher transaction fees and slower confirmation times during peak demand. As Bitcoin continues to grapple with these issues, its future predictions may hinge on the development of solutions like the Lightning Network, which aims to enable faster and cheaper transactions.

Investor Sentiment

Investor sentiment towards Bitcoin and Ethereum is often shaped by market cycles and external factors. Recent surveys indicate that a significant portion of investors view Bitcoin as a safe haven asset, while Ethereum is perceived as a growth opportunity due to its extensive use cases. Psychological factors, such as FOMO (Fear of Missing Out) and market speculation, heavily influence behavior across both cryptocurrencies.

Industry leaders express a bullish outlook for both assets, with many suggesting that diversification into Ethereum can provide substantial returns alongside Bitcoin holdings.

Regulatory Environment

The regulatory landscape for cryptocurrencies continues to evolve, impacting both Ethereum and Bitcoin. Governments worldwide are developing frameworks to regulate cryptocurrency exchanges and protect investors. For instance, the U.S. Securities and Exchange Commission (SEC) has scrutinized Ethereum’s initial coin offering (ICO), which has set precedents for future regulations.Regulations have historically influenced market behavior; for example, announcements of potential bans or stricter regulations in significant markets like China have led to sharp declines in prices.

As governments continue to establish clearer guidelines, the crypto market may witness increased stability and confidence.

Comparative Analysis

A side-by-side comparison of Bitcoin and Ethereum reveals distinct characteristics that cater to different investor preferences.

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Primary Use Case | Digital currency and store of value | Smart contracts and decentralized applications |

| Consensus Mechanism | Proof of Work | Transitioning to Proof of Stake |

| Market Capitalization | $800 billion (approx.) | $400 billion (approx.) |

| Transaction Speed | 7 transactions per second | 30 transactions per second (upgraded) |

Both cryptocurrencies have their strengths and weaknesses as investment vehicles. Bitcoin is often viewed as a more stable investment due to its established reputation, while Ethereum presents opportunities for higher returns due to its innovative technology and growing ecosystem. Community and developer support for both assets remains strong, contributing positively to their ongoing development and future prospects.

Conclusive Thoughts

In conclusion, the journey through ethereum and bitcoin predictions offers a glimpse into the dynamic and rapidly evolving landscape of digital currencies. As we consider the technological advancements, investor sentiments, and potential regulatory impacts, it becomes clear that both Bitcoin and Ethereum have unique advantages and challenges that could shape their trajectories. Staying informed and adaptable will be key for anyone looking to navigate this exciting sector of finance.

Common Queries

What is the main difference between Ethereum and Bitcoin?

Ethereum is primarily a platform for decentralized applications and smart contracts, while Bitcoin is mainly a digital currency used for peer-to-peer transactions.

How do global economic events affect cryptocurrency values?

Global economic events can lead to increased volatility in cryptocurrency values, as they often influence investor sentiment and market behavior.

What are the future predictions for Bitcoin’s price?

Experts suggest that Bitcoin could see significant price increases over the next year, driven by institutional adoption and market demand.

How will Ethereum’s technological advancements impact its price?

Technological advancements such as Ethereum 2.0 are expected to enhance scalability and efficiency, which could positively impact its market value.

What role do regulations play in cryptocurrency markets?

Regulations can greatly influence market behavior, affecting investor confidence and the overall adoption of cryptocurrencies.