Ethereum And Bitcoin News Current Trends And Insights

As ethereum and bitcoin news takes center stage, the cryptocurrency realm continues to evolve with dynamic shifts and trends. Recent developments in technology, market sentiment, and regulatory landscapes are shaping the future of these digital assets. Investors and enthusiasts alike are keen to understand how these factors interact and influence the trajectory of Ethereum and Bitcoin.

In this discussion, we'll explore the latest trends, technological advancements, and major events impacting Ethereum and Bitcoin, along with insights into market sentiments and predictions. Our goal is to provide a comprehensive overview that helps you navigate the ever-changing world of cryptocurrencies.

Current Trends in Ethereum and Bitcoin

The cryptocurrency market is always evolving, and both Ethereum and Bitcoin are currently experiencing notable trends. These trends reflect changing investor sentiments, regulatory updates, and technological advancements that are shaping the future of these digital assets.

Latest Market Trends

Recently, both Ethereum and Bitcoin have shown significant volatility influenced by various global events. Regulatory changes, particularly in the United States and Europe, have had a profound impact on how these cryptocurrencies are perceived and traded. Investors are responding to news regarding stricter regulations and the potential for institutional adoption. In the past month, Bitcoin's price has fluctuated between $25,000 and $30,000, while Ethereum has seen movement between $1,600 and $1,800, highlighting a period of consolidation.

Impact of Regulatory Changes

The regulatory landscape is crucial for the growth of cryptocurrencies. In the U.S., the SEC's approach to classifying digital assets has caused some uncertainty. Conversely, some countries are embracing blockchain technology, leading to positive sentiments in the market. These developments can lead to increased market participation, affecting both cryptocurrencies positively or negatively.

Recent Price Movements

Over the last month, both Ethereum and Bitcoin have followed somewhat parallel paths, with Bitcoin maintaining a higher market cap. Market news, adoption rates, and macroeconomic factors such as inflation and interest rate changes have contributed to these price trends.

Technological Developments in Ethereum and Bitcoin

Technological advancements play a vital role in the evolution of Ethereum and Bitcoin. As these networks progress, their capabilities and efficiencies are enhanced, attracting more users and developers.

Ethereum 2.0 Transition

Ethereum's transition to Ethereum 2.0 marks a significant technological upgrade, aiming to improve scalability and reduce energy consumption by shifting from a proof-of-work to a proof-of-stake mechanism. This transition has already begun to attract institutional investors who are looking for sustainable investment options.

Bitcoin Technology Innovations

Bitcoin is also making strides with improvements in transaction efficiency. The implementation of the Lightning Network is a key innovation, allowing for faster and cheaper transactions. This development is crucial for Bitcoin's adoption as a payment method, enhancing its usability in real-world scenarios.

Key Developers and Teams

Significant contributions to both networks come from dedicated teams. Vitalik Buterin continues to lead Ethereum's ongoing development, while teams like Blockstream focus on improving Bitcoin's infrastructure. These developers are instrumental in driving innovation and addressing challenges within their respective networks.

Market Sentiment and Predictions

Market sentiment plays a crucial role in the cryptocurrency landscape. Investor confidence can heavily influence price movements, making understanding this sentiment essential for predicting future trends.

Prevailing Market Sentiments

Currently, there is a cautious optimism surrounding both Ethereum and Bitcoin. As institutional adoption grows and regulatory clarity improves, investors are becoming more bullish. However, the fear of regulatory crackdowns continues to lurk, causing some hesitation among retail investors.

Expert Predictions

| Cryptocurrency | Expert Prediction (1 Year) |

|---|---|

| Bitcoin | $35,000 - $50,000 |

| Ethereum | $2,500 - $3,500 |

Factors Influencing Investor Confidence

Several factors influence investor confidence in Ethereum and Bitcoin, including technological advancements, regulatory updates, and macroeconomic conditions. The overall market sentiment can pivot quickly based on news related to these elements.

Major Events Impacting the Cryptocurrencies

A timeline of major events can provide insight into how Ethereum and Bitcoin have been affected in the last six months.

Timeline of Major Events

- June 2023: Ethereum’s transition to proof-of-stake completed.

- July 2023: Bitcoin ETF proposals submitted to SEC.

- August 2023: Major hack on a DeFi platform shakes investor confidence.

- September 2023: Positive regulatory news from the European Union boosts market sentiment.

Influence of Announcements

Significant announcements from both corporate and governmental bodies have a notable impact on market behavior. For instance, positive regulatory developments can lead to price rallies, while negative news can prompt sell-offs.

Market Reactions Comparison

Market reactions can differ significantly between Ethereum and Bitcoin. For example, when regulatory news broke, Bitcoin's price typically reacted more dramatically due to its status as the leading cryptocurrency, while Ethereum's movements were more tempered, reflecting its broader use case in the dApp ecosystem.

Adoption and Use Cases

The adoption of Ethereum and Bitcoin continues to expand across various industries, showcasing their utility beyond mere investment vehicles.

Increasing Use Cases for Ethereum

Ethereum is increasingly recognized for its role in decentralized applications (dApps). This platform provides infrastructure for projects ranging from finance to gaming, making it essential to the growing blockchain economy.

Bitcoin as Store of Value

Bitcoin is often referred to as "digital gold," and this perception is evolving as more institutional investors enter the space. The shift towards Bitcoin as a hedge against inflation is growing stronger among investors seeking stability in volatile markets.

Adoption by Companies and Industries

- Tesla: Accepted Bitcoin for vehicle purchases.

- Adobe: Uses Ethereum for digital asset management.

- Microsoft: Integrates blockchain technology into various services.

Security and Regulation

Security and regulatory compliance are paramount for the longevity and trust in Ethereum and Bitcoin networks.

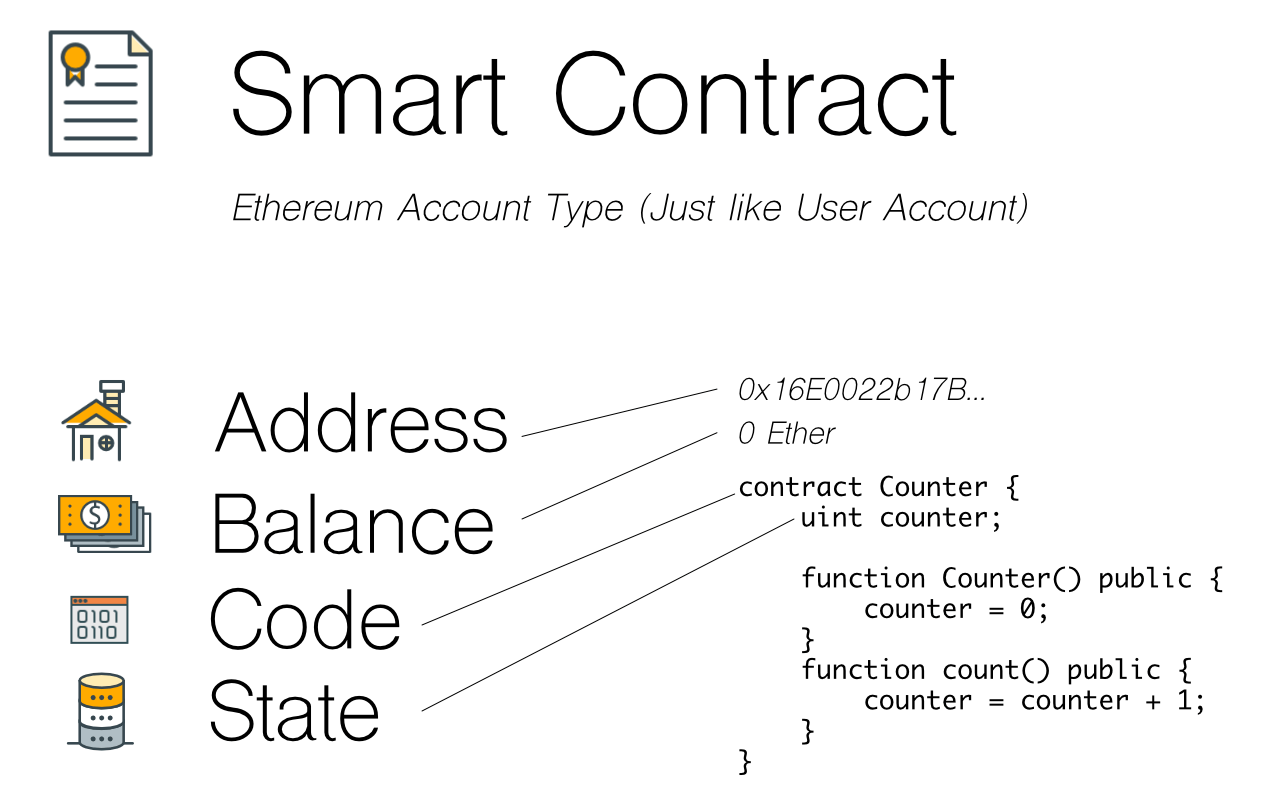

Security Measures

Both Ethereum and Bitcoin have implemented robust security measures. Bitcoin relies on its decentralized network and proof-of-work algorithm, while Ethereum employs smart contracts to enforce secure transactions.

Regulatory Challenges

The regulatory landscape poses challenges for both cryptocurrencies. Legal considerations vary significantly by country, affecting how each cryptocurrency is treated. Some nations embrace crypto, while others impose strict restrictions.

Comparative Regulatory Environment

The regulatory environments for Ethereum and Bitcoin vary across different countries. In the U.S., Bitcoin faces stringent scrutiny as a commodity, while Ethereum is often viewed through the lens of securities regulation, affecting its usage and development.

Community and Ecosystem

The communities surrounding Ethereum and Bitcoin are vibrant and play a significant role in their respective ecosystems.

Community Engagement

Both cryptocurrencies have strong communities that engage through forums and social media platforms like Reddit and Twitter. These discussions are vital for sharing information and fostering development.

Community-Driven Initiatives

Community-driven initiatives contribute significantly to the development of both networks. Grassroots movements often lead to important upgrades and improvements.

Partnerships and Collaborations

Both ecosystems have seen notable partnerships. Ethereum has collaborated with numerous projects in the DeFi space, while Bitcoin has formed alliances with payment processors to enhance transaction capabilities.

Investment Strategies

Investing in Ethereum and Bitcoin requires strategic planning and an understanding of market dynamics.

Investment Strategies Overview

Different investment strategies exist for both cryptocurrencies, from long-term holding to active trading. The approach taken can significantly impact overall returns.

Risk Levels Associated with Investment Approaches

| Investment Strategy | Risk Level |

|---|---|

| HODLing | Low |

| Day Trading | High |

| Dollar-Cost Averaging | Moderate |

Portfolio Diversification

Incorporating both Ethereum and Bitcoin into an investment portfolio can provide diversification benefits. A balanced approach allows investors to mitigate risks while capitalizing on the unique strengths of each cryptocurrency.

Closing Notes

In summary, the landscape of Ethereum and Bitcoin is rapidly changing, and staying informed is essential for anyone interested in these digital currencies. With ongoing technological innovations, shifting market sentiments, and evolving regulatory challenges, both Ethereum and Bitcoin present unique opportunities and risks. As we look forward, understanding these dynamics will be crucial for making informed investment decisions.

FAQ Guide

What is the difference between Ethereum and Bitcoin?

Ethereum is a platform for decentralized applications, while Bitcoin is primarily a digital currency aimed at being a store of value.

How do regulatory changes affect Ethereum and Bitcoin?

Regulatory changes can impact market confidence, trading volumes, and the legal status of transactions in different jurisdictions.

What are the implications of Ethereum 2.0?

Ethereum 2.0 aims to improve scalability and energy efficiency, transitioning from proof-of-work to proof-of-stake consensus.

Can investing in Bitcoin be considered safe?

While Bitcoin has shown resilience, it remains volatile, and potential investors should consider their risk tolerance before investing.

What role do communities play in the development of cryptocurrencies?

Communities contribute to the growth and innovation of cryptocurrencies through collaboration, feedback, and grassroots initiatives.