Whats The Difference Between Bitcoin And Ethereum Explained

What’s the difference between bitcoin and ethereum? This question brims with curiosity as these two cryptocurrencies have taken the digital world by storm, each carving out its own niche in the ever-evolving landscape of blockchain technology. While Bitcoin is often regarded as digital gold, Ethereum emerges as a powerhouse for decentralized applications, presenting unique functionalities and use cases that set them apart.

Exploring their origins reveals fascinating stories; Bitcoin was created as a revolutionary alternative to traditional currency, while Ethereum was designed to facilitate smart contracts and decentralized apps, pushing the boundaries of what blockchain can do. Understanding their underlying technologies, from consensus mechanisms to transaction speeds, is crucial in grasping how they operate and their respective roles in the cryptocurrency ecosystem.

Overview of Bitcoin and Ethereum

Bitcoin and Ethereum are the two leading cryptocurrencies in the digital landscape. Bitcoin, created in 2009 by an anonymous person or group of people known as Satoshi Nakamoto, was the first cryptocurrency and serves primarily as a digital alternative to traditional currencies. Its primary purpose is to enable peer-to-peer transactions over a decentralized network, ensuring security and anonymity.Ethereum, launched in 2015 by Vitalik Buterin and a team of developers, extends the capabilities of blockchain technology beyond just currency.

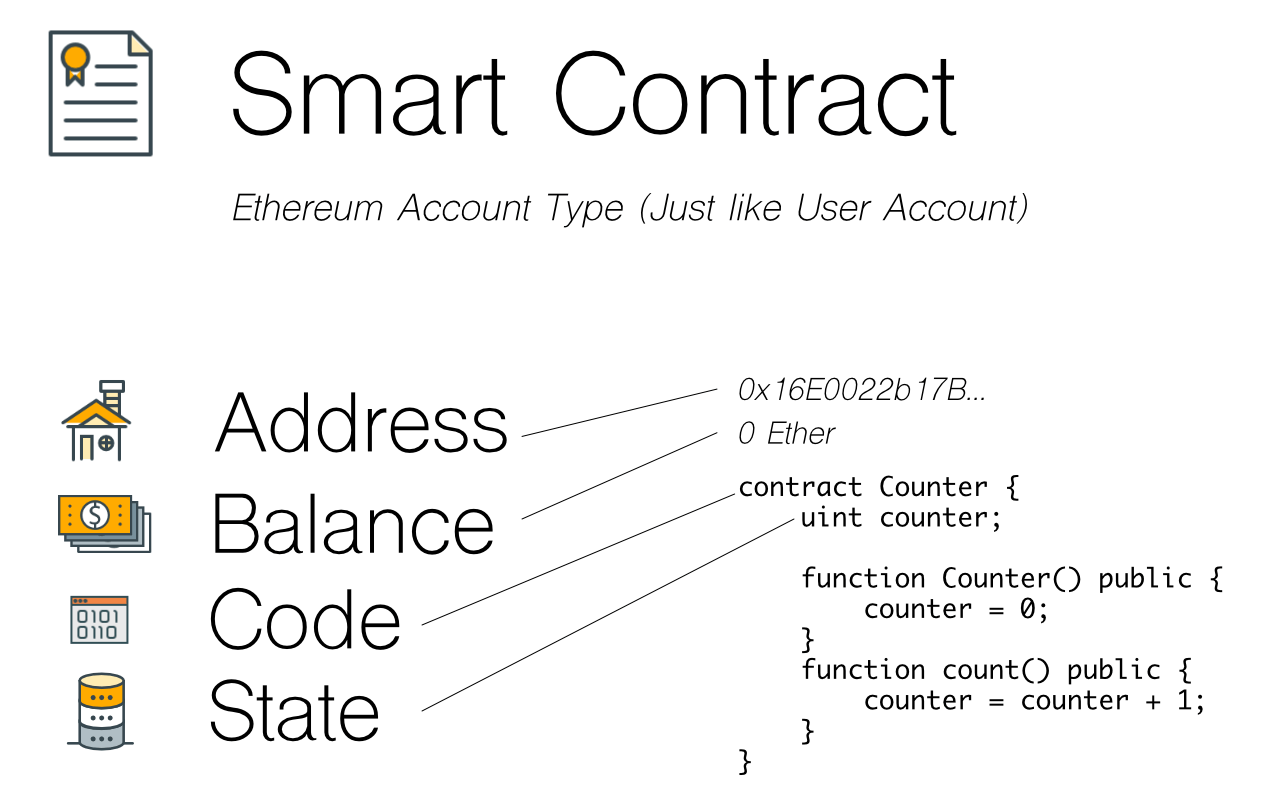

It was designed to facilitate smart contracts and decentralized applications (dApps), allowing developers to build and deploy various applications on its platform. Both Bitcoin and Ethereum rely on blockchain technology, a distributed ledger that records all transactions securely and transparently.

Key Technical Differences

The technical foundations of Bitcoin and Ethereum differ significantly, particularly in their consensus mechanisms and transaction capabilities.

- Bitcoin employs the Proof of Work (PoW) consensus mechanism, which requires miners to solve complex mathematical problems to validate transactions and secure the network. This process, while secure, can be slow and energy-intensive.

- Ethereum is transitioning from PoW to Proof of Stake (PoS) with its Ethereum 2.0 upgrade. This new mechanism allows validators to create new blocks based on the number of coins they hold and are willing to “stake,” making it more energy-efficient and faster in processing transactions.

- Transaction speeds vary greatly between the two networks. Bitcoin typically processes transactions every 10 minutes, while Ethereum can handle transactions in a matter of seconds, making it more suitable for applications requiring quick confirmations.

- Ethereum’s programming capabilities are more advanced than Bitcoin’s. Ethereum uses a Turing-complete language called Solidity, allowing developers to write complex smart contracts, whereas Bitcoin’s scripting language is limited and primarily focused on basic transactions.

Use Cases and Applications

Bitcoin and Ethereum serve distinct purposes in the cryptocurrency ecosystem, leading to different use cases.

- Bitcoin is primarily used as a store of value and a medium of exchange. It is often referred to as “digital gold,” appealing to investors looking for a hedge against inflation and economic instability.

- Ethereum supports a wide range of applications within the decentralized finance (DeFi) space, enabling functions such as lending, borrowing, and trading without intermediaries. Its ecosystem includes decentralized exchanges (DEXs), stablecoins, and yield farming platforms.

- In real-world scenarios, Bitcoin is often used for remittances and online purchases, while Ethereum powers applications like decentralized autonomous organizations (DAOs) and non-fungible tokens (NFTs), showcasing its versatility beyond currency.

Economic Models and Supply

The economic structures of Bitcoin and Ethereum reflect their different objectives and impacts on their respective values.

- Bitcoin has a capped supply of 21 million coins, which creates scarcity and can drive up its value as demand increases. This fixed supply is designed to mimic precious metals and create a deflationary environment.

- Ethereum, on the other hand, has adopted an inflationary model where new coins are minted continuously. This approach allows for flexibility in network upgrades and incentivizes participation, but it raises concerns about long-term value retention.

- Miners in Bitcoin are rewarded with newly minted coins and transaction fees, which incentivizes network security. In Ethereum, validators are rewarded through transaction fees and staking rewards, promoting active participation in maintaining the network.

Community and Development

The communities supporting Bitcoin and Ethereum play crucial roles in their growth and evolution.

- Bitcoin has a robust community of developers and enthusiasts who focus on security, stability, and adhering to its original vision. The governance structure relies heavily on consensus within this community, which can slow down the decision-making process.

- Ethereum’s development community is highly active, frequently upgrading the network to enhance functionality and performance. The Ethereum Improvement Proposal (EIP) process allows for collaborative development and implementation of new features.

- While Bitcoin’s governance is more conservative, Ethereum embraces flexibility and innovation, leading to rapid advancements and adapting to market needs.

Security Features

Security is paramount for both Bitcoin and Ethereum, though they face different challenges.

- Bitcoin employs strong cryptographic techniques and a decentralized network of miners to prevent fraud and double spending. Its simplicity makes it less susceptible to complex vulnerabilities.

- Ethereum’s flexibility in smart contracts can lead to security challenges, as poorly written contracts can be exploited. The community actively works on improving security and auditing protocols to mitigate these issues.

- Both networks have demonstrated significant resilience against attacks, with Bitcoin’s long-standing security track record and Ethereum’s ongoing efforts to enhance its protective measures.

Future Prospects

The future of Bitcoin and Ethereum is subject to ongoing developments and innovations.

- Bitcoin’s potential future developments include the implementation of the Lightning Network, which aims to improve scalability and transaction speeds, enabling microtransactions and enhancing user experience.

- Ethereum’s roadmap includes further upgrades to its PoS model, reducing energy consumption and increasing transaction throughput, which are crucial for the growing DeFi ecosystem.

- Long-term visions for Bitcoin include maintaining its role as a store of value, while Ethereum aims to become the backbone of decentralized applications, fostering a vibrant ecosystem for innovation in the blockchain space.

Concluding Remarks

In summary, while both Bitcoin and Ethereum play pivotal roles in the cryptocurrency sphere, they serve distinct purposes that cater to different needs within the digital economy. Bitcoin’s fixed supply and role as a store of value contrast sharply with Ethereum’s flexible platform for innovation and decentralized finance. As the crypto landscape continues to evolve, keeping an eye on these two giants will provide insights into their future trajectories and influence on the financial world.

Question Bank

What is the main purpose of Bitcoin?

Bitcoin was created as a decentralized digital currency to serve as an alternative to traditional money, allowing peer-to-peer transactions without intermediaries.

How does Ethereum’s smart contract work?

Smart contracts on Ethereum are self-executing contracts with the terms of the agreement directly written into code, enabling automated transactions and agreements without the need for a third party.

Which cryptocurrency is better for investment?

The choice between Bitcoin and Ethereum as an investment depends on individual financial goals and risk tolerance, as they present different opportunities and risks.

Can Ethereum surpass Bitcoin in the future?

While Ethereum has the potential for significant growth due to its versatile applications, Bitcoin’s established status as a store of value presents a robust competition for dominance in the market.

What are the transaction fees like for both cryptocurrencies?

Transaction fees for Bitcoin can vary widely depending on network congestion, while Ethereum’s fees are influenced by the complexity of transactions, especially during high demand periods.