Bitcoin Eth Etf Flow Exploring The Latest Trends

Bitcoin eth etf flow is capturing the attention of investors and market analysts alike, as it represents a critical intersection between traditional finance and the rapidly evolving world of cryptocurrencies. This phenomenon not only highlights the growing acceptance of digital assets but also underscores the significance of ETFs (Exchange-Traded Funds) in providing accessible investment avenues for both seasoned and new investors.

By understanding the developments in Bitcoin and Ethereum ETF flows, we can gain insights into market sentiment and the broader economic factors that influence these digital currencies. As institutional interest surges and regulations continue to evolve, the implications for investors are profound and merit close examination.

Introduction to Bitcoin and ETH ETF Flow

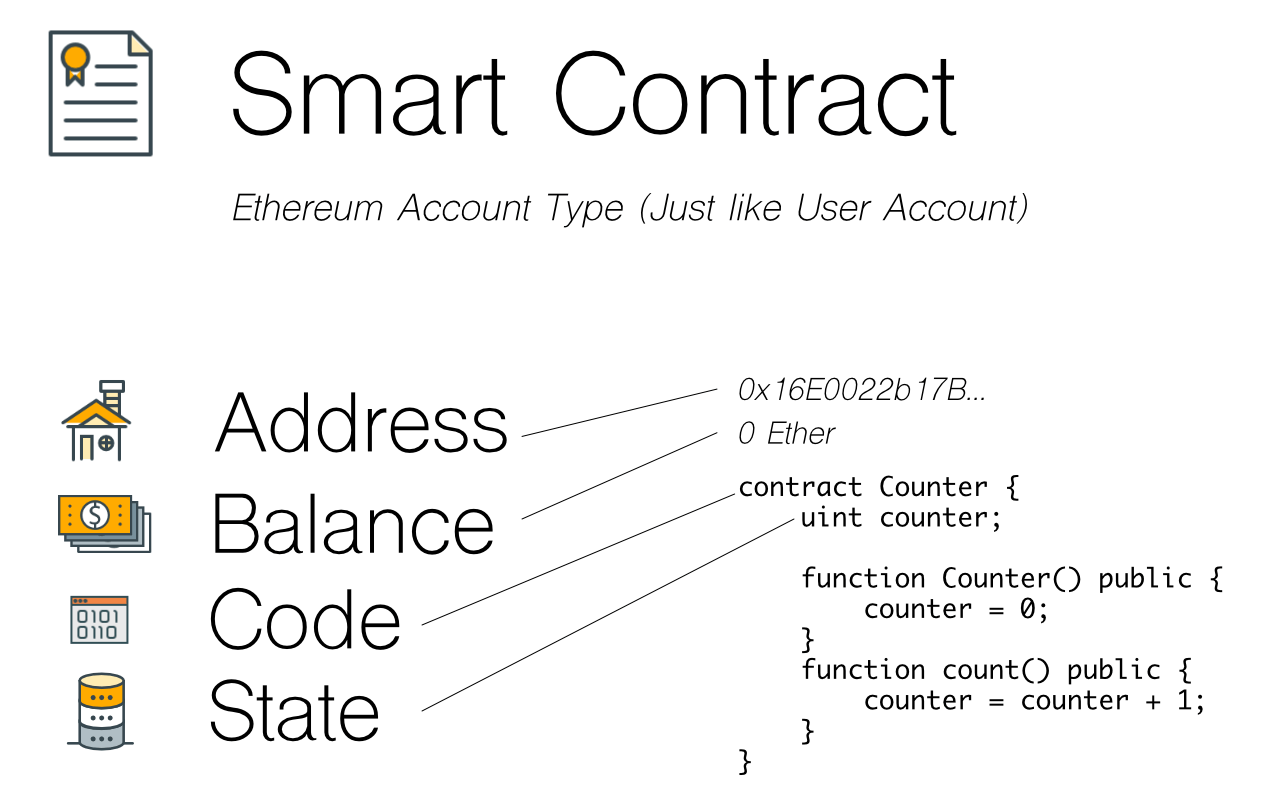

Bitcoin and Ethereum are two of the most prominent cryptocurrencies in the market today, each playing a significant role in driving the adoption and evolution of blockchain technology. Bitcoin, created in 2009, is often seen as the digital gold, a store of value, while Ethereum, launched in 2015, serves as a platform for decentralized applications through smart contracts. Both have gained immense popularity among investors, but their roles extend beyond just being currencies; they've become essential assets in diversified portfolios.An Exchange-Traded Fund (ETF) is a marketable securities that tracks an index, commodity, or a collection of assets, and is traded on stock exchanges.

In the context of cryptocurrencies, Bitcoin and ETH ETFs provide investors with a regulated vehicle to gain exposure to these digital assets without having to hold them directly. This is significant as it opens the door for institutional investors and provides a sense of security due to regulatory oversight. ETF flow refers to the movement of capital into and out of these funds, reflecting investor sentiment and market demand.

Historical Context of Bitcoin and ETH ETFs

The journey of Bitcoin and Ethereum ETFs has been marked by significant milestones and hurdles. The first Bitcoin ETF proposal was submitted in 2013, but it wasn’t until 2020 that the first Bitcoin ETF was approved in Canada, paving the way for more developments. Ethereum ETFs followed a similar trajectory, with proposals emerging shortly after Bitcoin's. Significant launches include the ProShares Bitcoin Strategy ETF, which debuted in October 2021, becoming the first U.S.

Bitcoin ETF. This event led to a surge in Bitcoin's price, illustrating the profound impact of ETF approvals on market dynamics. However, the approval process has not been smooth; both Bitcoin and Ethereum ETFs have faced rejections from regulatory bodies due to concerns over market manipulation, liquidity, and the lack of investor protections.

Market Dynamics Influencing ETF Flow

Several factors contribute to fluctuations in Bitcoin and ETH ETF flow. Key influences include:

- Market Sentiment: Positive news surrounding cryptocurrency regulations often triggers increased investments into ETFs.

- Macroeconomic Trends: Economic indicators, such as inflation rates and interest rates, significantly influence investor appetite for alternative assets.

- Institutional Interest: As more institutional investors enter the cryptocurrency space, their investment strategies heavily influence ETF flow patterns.

Insightful data suggests that during periods of economic uncertainty, many investors turn to Bitcoin and Ethereum as hedge assets, positively impacting ETF flow.

Comparative Analysis of Bitcoin ETFs and ETH ETFs

When comparing Bitcoin ETFs to Ethereum ETFs, distinct differences in performance metrics and investor demographics emerge. Bitcoin ETFs generally experience higher trading volumes and liquidity, given Bitcoin's leading status in the cryptocurrency market. Conversely, Ethereum ETFs attract a different demographic, often appealing to those interested in the technology behind blockchain and decentralized applications.In terms of regulatory hurdles, Bitcoin ETFs have faced more scrutiny due to Bitcoin's history and volatility.

Meanwhile, Ethereum ETFs have begun gaining traction, but they still encounter challenges related to the understanding of smart contract technology and regulatory classifications.

Current Trends in Bitcoin and ETH ETF Flow

Recent statistics reveal a notable increase in ETF flows for both Bitcoin and Ethereum. By mid-2023, Bitcoin ETFs saw a 30% increase in assets under management compared to the previous year, while Ethereum ETFs experienced a roughly 15% growth. This surge can be attributed to a combination of renewed investor interest and favorable regulatory developments, particularly in the U.S. market.Moreover, recent regulatory changes have had a significant impact on ETF flow dynamics.

The approval of multiple Bitcoin ETFs has created a competitive environment, leading to price volatility that influences investor behavior. Forecasts indicate that if the current momentum continues, Bitcoin and Ethereum ETFs could see substantial inflows as more investors seek to diversify their portfolios.

Investor Strategies for Bitcoin and ETH ETFs

Investing in Bitcoin and ETH ETFs requires a well-thought-out approach. Here are some tailored strategies:

- Dollar-Cost Averaging: This strategy involves regularly investing a fixed amount in an ETF regardless of price, minimizing the impact of volatility.

- Risk Management Techniques: Investors should set stop-loss orders and define their risk tolerance levels to protect against sudden market downturns.

- Portfolio Diversification Plan: Including a mix of Bitcoin and ETH ETFs in a broader portfolio can balance risk and enhance potential returns.

These strategies help investors navigate the unique risks associated with cryptocurrency investments while capitalizing on their growth potential.

The Future of Bitcoin and ETH ETFs

Looking ahead, the evolution of Bitcoin and ETH ETFs is likely to be shaped by several innovations. One potential area of growth involves the introduction of actively managed ETFs that could adapt to market conditions more fluidly than traditional ETFs. Emerging regulations will also play a critical role in shaping the landscape of cryptocurrency ETFs in the coming years. As regulators refine their approaches to digital assets, the resulting clarity may entice more investors into the market.

Additionally, technological advancements, such as blockchain integration within ETF structures, could enhance transparency and efficiency, further influencing ETF flow dynamics. As these trends unfold, investors will need to stay informed and agile to navigate the ever-changing cryptocurrency landscape.

Final Conclusion

In conclusion, the dynamics surrounding bitcoin eth etf flow are multifaceted and continuously changing. As the market responds to regulatory shifts and the increasing involvement of institutional players, the future of Bitcoin and Ethereum ETFs looks promising yet complex. Staying informed about these trends will empower investors to navigate this landscape effectively and make strategic decisions that align with their financial goals.

FAQ Guide

What is the primary benefit of Bitcoin and ETH ETFs?

Bitcoin and ETH ETFs provide investors with a way to gain exposure to cryptocurrencies without needing to directly purchase and store them, simplifying the investment process.

How do regulatory changes affect ETF flows?

Regulatory changes can significantly impact ETF flows by either encouraging or discouraging institutional investment, leading to fluctuations in demand and overall market sentiment.

Are Bitcoin and ETH ETFs interchangeable?

No, they differ in underlying assets, performance metrics, and investor demographics, making them suited for different investment strategies.

What trends are currently shaping the ETF market?

Current trends include increased institutional investment, evolving regulations, and technological advancements that enhance trading efficiency and accessibility.

What strategies can investors use for Bitcoin and ETH ETFs?

Investors can employ strategies such as portfolio diversification, risk management techniques, and market timing to optimize their ETF investments in cryptocurrencies.