eth crypto price prediction Insights and Trends Ahead

As eth crypto price prediction takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

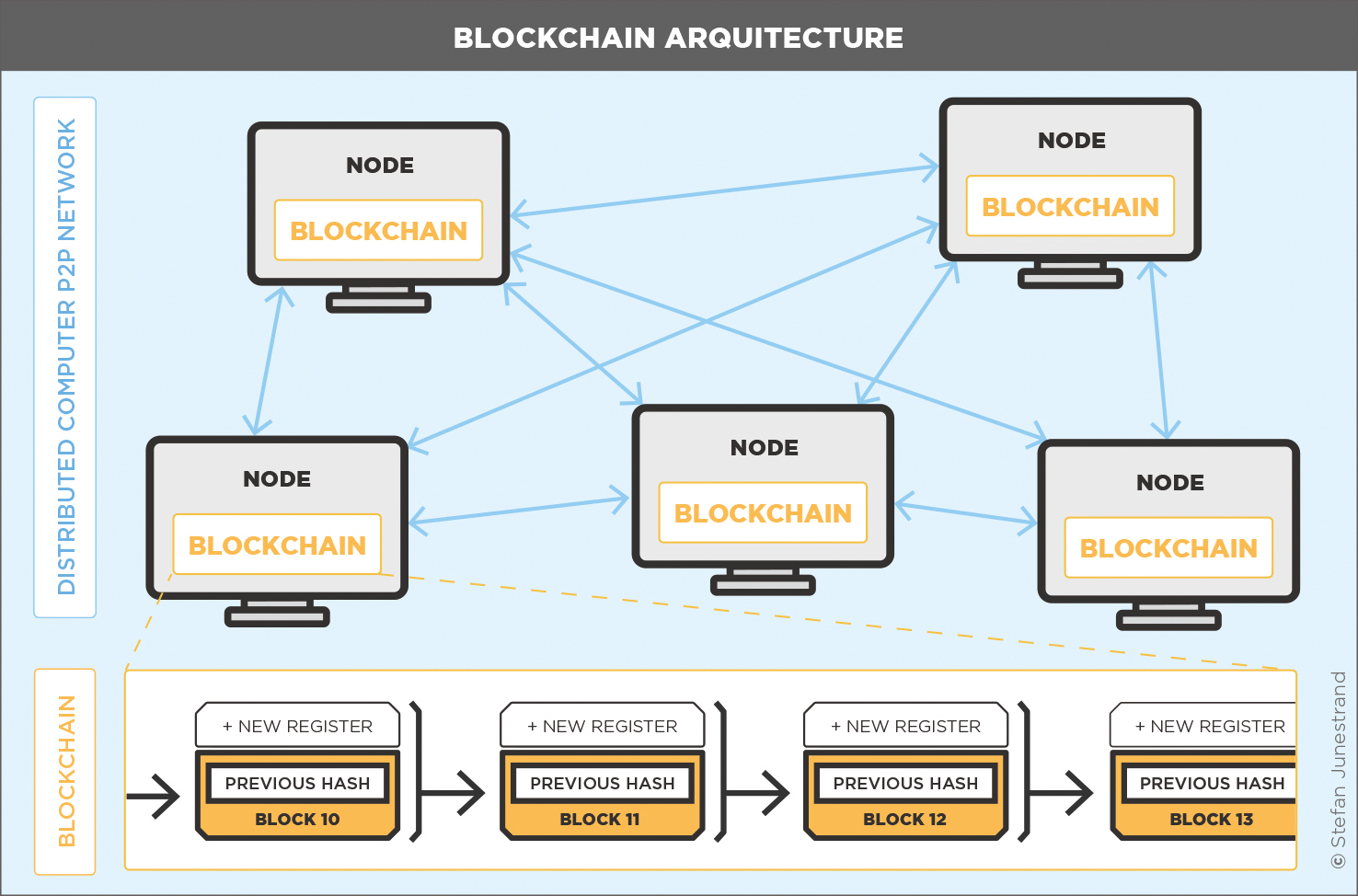

The current landscape of Ethereum is both dynamic and complex, influenced by various market trends, recent developments, and historical price movements. With the growing interest in cryptocurrencies, understanding Ethereum's price predictions is crucial for investors and enthusiasts alike.

Current State of Ethereum

The current price of Ethereum reflects a dynamic landscape influenced by various market factors. As of now, Ethereum's price hovers around $2,000, but it is subject to rapid changes due to fluctuating investor sentiment, regulatory news, and technological advancements within the Ethereum ecosystem. One significant factor affecting its price is the overall market trends, which often mirror the movements of Bitcoin.

Additionally, recent events such as major upgrades and partnerships have also impacted Ethereum’s valuation.

Key Market Trends Influencing Ethereum's Price

In recent months, several market trends have emerged that significantly influence Ethereum's price. These trends include:

- Increased institutional adoption, with more companies integrating Ethereum into their operations.

- Surge in decentralized finance (DeFi) projects, driving demand for Ethereum-based transactions.

- Market volatility, with frequent price swings often triggered by broader economic news.

Recent News or Events Impacting Ethereum's Value

Several notable events have shaped Ethereum's value recently. The rollout of Ethereum 2.0, focusing on transitioning to a proof-of-stake model, aims to enhance scalability and energy efficiency. Furthermore, partnerships with financial institutions have increased confidence in Ethereum's long-term viability, while regulatory scrutiny continues to loom over the crypto market, affecting investor sentiment.

Historical Price Trends of Ethereum

An examination of Ethereum's price history reveals substantial growth and volatility since its inception in 2015. Initially, Ethereum was priced below $1, but it surged to an all-time high of approximately $4,800 in November 2021. This dramatic increase highlights the cryptocurrency's potential and the factors that drive its price.

Significant Price Movements Over the Past Few Years

The past few years have seen several significant price movements:

- In 2017, Ethereum's price skyrocketed from around $8 to over $1,400, driven by the ICO boom.

- In 2020, Ethereum hit $600 amidst the DeFi craze, marking a resurgence in interest.

- In 2021, the price reached its peak, only to experience corrections throughout 2022 and 2023.

Correlation Between Ethereum's Price and Bitcoin's Price Changes

Ethereum's price movements often correlate with Bitcoin’s price, with both cryptocurrencies experiencing similar trends during market fluctuations. For instance, when Bitcoin rallies, Ethereum typically follows suit, demonstrating a close relationship between the two assets. This correlation can be attributed to shared market sentiment and investor behavior within the cryptocurrency space.

Influential Factors on Ethereum's Price

Several factors play a crucial role in determining Ethereum's price. Understanding these influences can help investors make informed decisions.

Market Sentiment and Its Effects

Market sentiment is a powerful driver of Ethereum's price. Positive news, such as adoption by major firms or successful updates, tends to boost prices, while negative news can lead to sharp declines. Investor psychology, often influenced by social media trends and news cycles, can create volatility in Ethereum’s valuation.

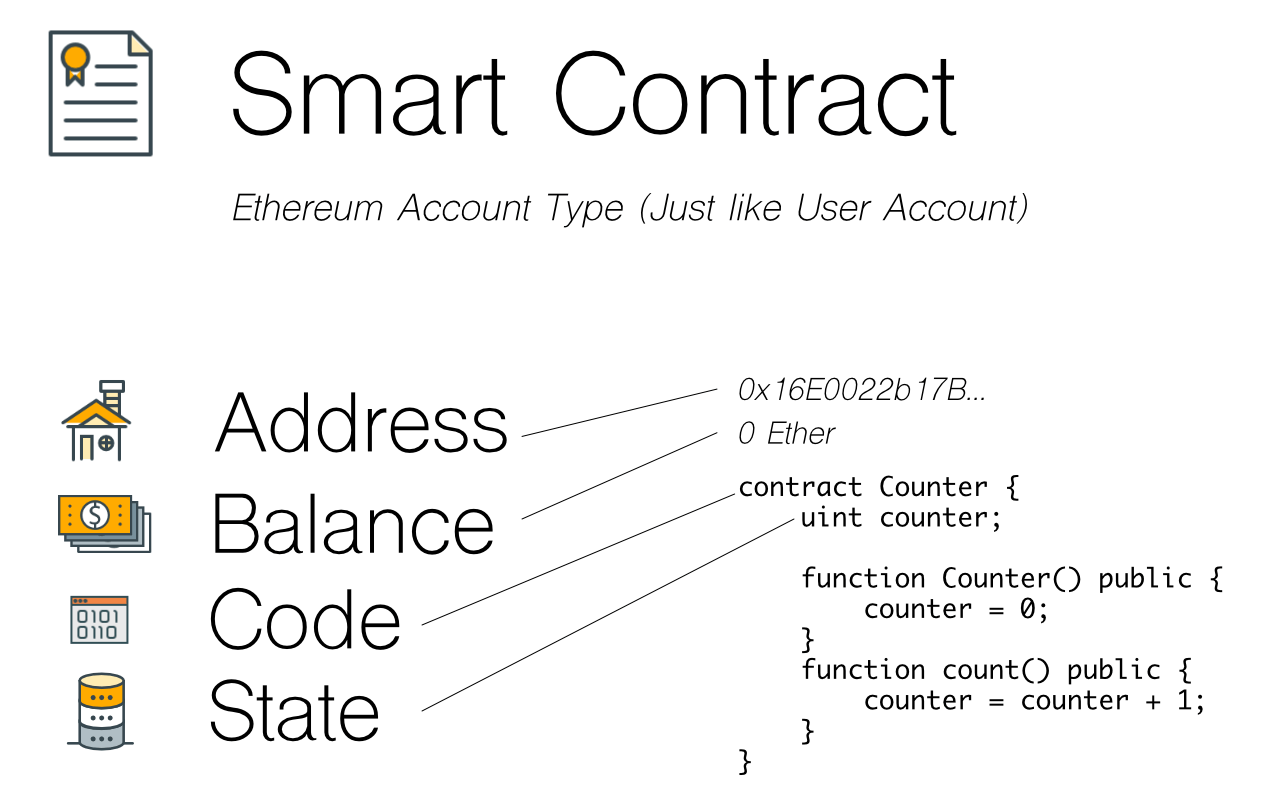

Technological Advancements in Ethereum’s Ecosystem

Technological developments, particularly the transition to Ethereum 2.0, significantly impact Ethereum's price. The upgrade promises to improve scalability, reduce transaction fees, and enhance security, which can attract more users and investors to the network.

External Economic Factors Impacting Ethereum’s Valuation

Broader economic conditions also affect Ethereum's price. Inflation rates, interest rates, and macroeconomic stability can lead to changes in investor behavior. For example, during economic uncertainty, investors may flock to cryptocurrencies like Ethereum as a hedge against traditional market risks.

Price Prediction Models for Ethereum

Predicting Ethereum's price involves various methodologies, each with its own strengths and weaknesses.

Models Used for Predicting Ethereum's Price

Several models are utilized for forecasting Ethereum’s price, including:

- Technical analysis, which examines historical price patterns and trends.

- Fundamental analysis, focusing on the underlying value and utility of Ethereum.

- Sentiment analysis, which gauges market mood through social media and news sentiment.

Examples of Technical Analysis Tools

Common technical analysis tools applied to Ethereum include:

- Moving Averages: Used to identify trends over specific time frames.

- Relative Strength Index (RSI): Measures the speed and change of price movements to identify overbought or oversold conditions.

- Bollinger Bands: Helps determine volatility and potential price movements.

Fundamental Analysis Versus Technical Analysis for Ethereum Price Forecasting

Fundamental analysis focuses on Ethereum's intrinsic value and future potential, while technical analysis relies on price charts and historical data. Both approaches offer unique insights, but combining them can provide a more comprehensive view of potential price movements.

Expert Opinions and Forecasts

Insights from cryptocurrency analysts can provide valuable perspectives on Ethereum's future price trajectory.

Insights from Cryptocurrency Analysts

Analysts often share their forecasts based on market trends, technological developments, and macroeconomic factors. Many predict that Ethereum could experience significant growth due to its ongoing upgrades and increasing adoption in various sectors.

Different Price Forecast Scenarios Provided by Experts

Experts present a range of price scenarios for Ethereum, including:

- Optimistic forecasts, suggesting prices could exceed $5,000 if market conditions remain favorable.

- Conservative estimates, predicting prices to stabilize around $2,500 amid regulatory pressures.

- Bearish scenarios, where Ethereum could drop below $1,500 if negative market sentiments persist.

Factors Behind Varying Expert Predictions

Discrepancies in expert predictions stem from differing assumptions about market dynamics, technological advancements, and macroeconomic conditions. Each analyst's perspective is influenced by their interpretation of data and market sentiment.

Community Sentiment and Its Impact

The cryptocurrency community plays a significant role in shaping Ethereum's price through discussions and sentiment on social media.

How Community Sentiment Influences Ethereum’s Price

Community sentiment, often expressed on platforms like Twitter and Reddit, can create substantial price movements. Positive buzz around developments can lead to increased buying activity, while negative sentiment may trigger sell-offs.

Sentiment Analysis Tools Focused on Ethereum

Tools that analyze sentiment include:

- Social media tracking platforms that monitor discussions and trends around Ethereum.

- Sentiment score aggregators that quantify the overall mood of discussions in the community.

Discussions from Cryptocurrency Forums Regarding Future Price Expectations

Active discussions on forums like Bitcointalk and Ethereum's Reddit page often reveal community expectations for future price movements. These discussions can reflect the collective sentiment and influence trading behavior.

Long-term vs Short-term Predictions

Understanding the distinctions between long-term and short-term price predictions for Ethereum can help investors strategize effectively.

Differences Between Short-term and Long-term Price Predictions

Short-term predictions often focus on immediate market movements and can change rapidly due to news or events. In contrast, long-term predictions consider the broader trends and developments in the Ethereum ecosystem, providing a more stable outlook for investors.

Framework for Evaluating Risks Associated with Each Prediction Timeframe

Investors should assess risks based on their investment horizon:

- Short-term risks may include high volatility and market manipulation.

- Long-term risks often involve regulatory changes and technological setbacks.

Strategies for Traders Based on Short-term and Long-term Forecasts

Traders can adopt various strategies depending on their timeframes:

- Short-term traders may utilize technical analysis for rapid trades based on momentum.

- Long-term investors should focus on fundamental analysis and the overall health of the Ethereum network.

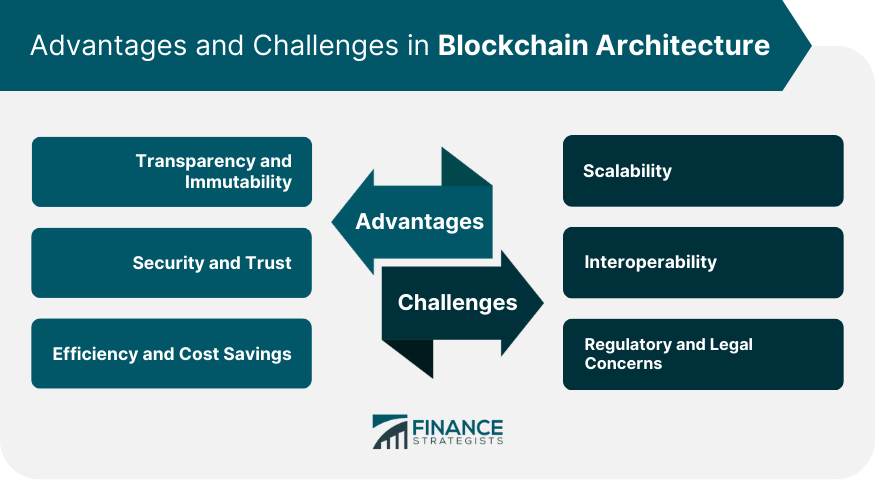

Potential Risks and Challenges

Ethereum's price is susceptible to various risks that could negatively impact its valuation.

Potential Risks Affecting Ethereum's Price

Key risks include:

- Market volatility, which can lead to unpredictable price swings.

- Regulatory challenges that may impose restrictions on cryptocurrencies.

- Technological vulnerabilities that could undermine investor confidence.

Regulatory Challenges Impacting the Cryptocurrency Market

Regulations surrounding cryptocurrencies are rapidly evolving. Governments worldwide are scrutinizing digital assets, and any adverse regulations could significantly affect Ethereum's price.

Impact of Market Volatility on Ethereum Price Stability

Market volatility plays a crucial role in Ethereum's price stability. Sudden price fluctuations can lead to panic selling or buying, further exacerbating volatility and affecting long-term growth.

Predictions Based on Technical Indicators

Technical indicators are valuable tools for forecasting Ethereum's price movements.

Key Technical Indicators for Price Predictions

Important technical indicators include:

- Moving Averages: Help identify trends by smoothing price data.

- MACD (Moving Average Convergence Divergence): Indicates momentum changes.

- Fibonacci Retracement: Assists in identifying potential reversal levels.

Methods for Using Moving Averages, RSI, and Other Indicators

Traders can apply these indicators in various ways:

- Using moving averages to determine entry and exit points based on crossover signals.

- Employing RSI to gauge overbought or oversold conditions before making trades.

- Utilizing Fibonacci levels to set target prices and stop-loss orders.

Guide for Interpreting Technical Signals Related to Ethereum

Understanding technical signals is crucial for traders. A comprehensive approach involves:

- Monitoring multiple indicators to confirm trends.

- Being aware of market conditions that may affect indicator reliability.

Future Developments and Their Implications

Looking ahead, several upcoming developments may influence Ethereum's price trajectory.

Upcoming Ethereum Upgrades and Their Potential Impact

The transition to Ethereum 2.0 represents a significant upgrade that promises to enhance the network's capabilities. Improvements such as reduced transaction costs and increased efficiency could attract more users and investors.

Transition to Ethereum 2.0 and Future Valuations

Ethereum 2.0's launch is expected to bolster Ethereum's valuation over the long term. As the network becomes more scalable and eco-friendly, it could solidify its position as a leading platform for decentralized applications.

Significance of Decentralized Finance (DeFi) Growth on Ethereum Pricing

The growth of DeFi projects that utilize the Ethereum blockchain contributes to increased demand and usage. As more users engage with DeFi, Ethereum's value could rise, reflecting its prominence in the cryptocurrency ecosystem.

Epilogue

In conclusion, navigating the intricacies of eth crypto price prediction requires a solid grasp of market factors, price models, and expert insights. As the Ethereum landscape continues to evolve, staying informed will empower investors to make better decisions in this ever-changing market.

Frequently Asked Questions

What factors influence Ethereum's price?

Several factors, including market sentiment, technological advancements, and economic conditions, can affect Ethereum's price.

How does Ethereum's price correlate with Bitcoin?

Historically, Ethereum's price movements often reflect trends seen in Bitcoin due to market dynamics and investor behavior.

What are common prediction models for Ethereum?

Common prediction models include technical analysis tools, fundamental analysis, and various algorithmic forecasting methods.

Are short-term predictions more reliable than long-term ones?

Short-term predictions can be influenced by immediate market fluctuations, while long-term predictions consider broader trends, making them generally more reliable.

What risks should investors be aware of?

Investors should be mindful of market volatility, regulatory challenges, and the potential for technological disruptions.